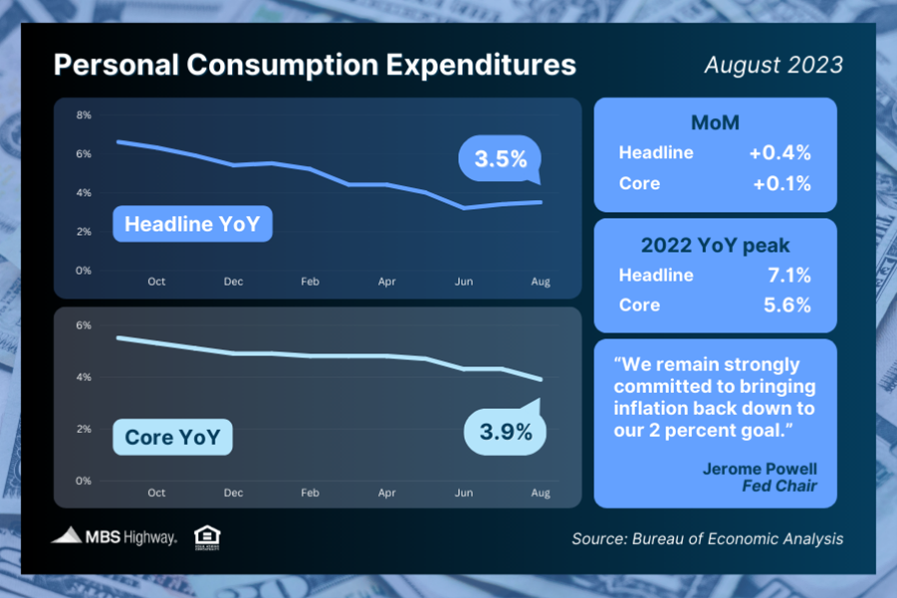

August’s Personal Consumption Expenditures (PCE) showed that headline inflation increased by a lower-than-expected 0.4%. The year-over-year reading rose from 3.4% to 3.5%, though the increase was due to revisions in prior reporting. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, rose by 0.1% in August with the year-over-year reading falling from 4.3% to 3.9% – the lowest level in two years.

What’s the bottom line? The Fed has hiked its benchmark Fed Funds Rate (the overnight borrowing rate for banks) eleven times since March of last year to try to slow the economy and curb inflation. While inflation is still elevated, it has made a big improvement from the 7.1% peak seen last year and is now less than half that amount at 3.5% on the headline reading.

Plus, if we annualize the last six months’ worth of Core PCE readings (which the Fed did during their last meeting), Core PCE would equal 2.9%. This is a large drop from 3.4% in the previous report and not far above their 2% target. Will this progress be enough for the Fed to pause further rate hikes? We’ll find out at their next meeting on November 1.