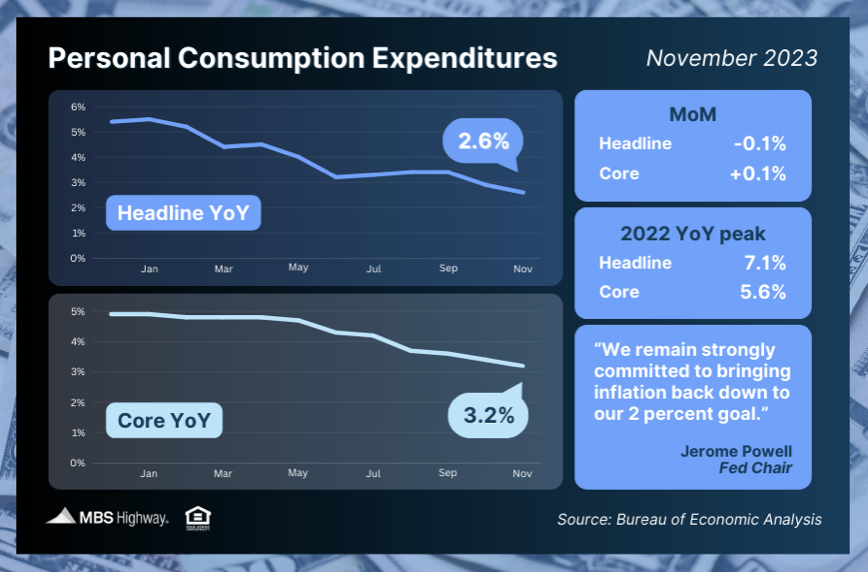

November’s Personal Consumption Expenditures (PCE) showed that headline inflation fell 0.1% for the month, with the year-over-year reading down from 2.9% to 2.6%. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, rose by 0.1% in November. The year-over-year reading fell from 3.4% to 3.2% – the lowest level in more than two years.

What’s the bottom line? Inflation has made significant progress lower after peaking last year, with the headline reading at 2.6% (down from 7.1%) and the core reading at 3.2% (down from 5.6%). Plus, annualizing the last six months’ worth of readings puts Core PCE at 1.85%, which is below the Fed’s 2% target!

Remember, the Fed has been hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) to try to slow the economy and curb inflation.

Their latest hike in July was the eleventh since March of last year, pushing the Fed Funds Rate to the highest level in 22 years.

The Fed did not hike at their last three meetings, so they could continue to assess incoming inflation, labor sector and other economic data. While the Fed has not ruled out additional rate hikes if warranted to keep inflation in check, they have suggested that rate cuts are ahead. After this month’s meeting, the “dot plot” of Fed member forecasts for where policy rates will be in a year showed that 15 out of 19 members expect cuts between 50 and 100 basis points over the course of next year.