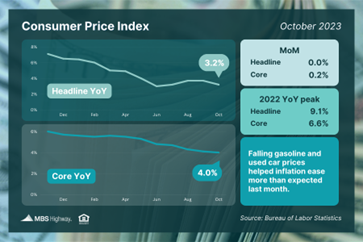

October’s Consumer Price Index (CPI) showed that inflation was flat compared to September, with this monthly reading coming in below the consensus estimate of a 0.1% gain. On an annual basis, CPI fell from 3.7% to 3.2%, near the lowest level in more than two years. Core CPI, which strips out volatile food and energy prices, increased 0.2% while the annual reading declined from 4.1% to 4%, reaching a two-year low. Declining gasoline and used car prices and moderating shelter costs helped keep a lid on inflation last month, even in the face of rising costs for motor vehicle and health insurance.

What’s the bottom line? Inflation has made significant progress lower after peaking last year, with the headline reading now at 3.2% (down from 9.1%) and the core reading at 4% (down from 6.6%). Remember, the Fed has been hiking its benchmark Fed Funds Rate (which is the overnight borrowing rate for banks) to try to slow the economy and curb inflation. Their latest hike in July was the eleventh since March of last year, pushing the Fed Funds Rate to the highest level in 22 years. The Fed did not hike at their September or November meetings, so they could continue to assess incoming inflation, labor sector and other economic data. Has there been enough progress for another pause at the Fed’s next meeting? We’ll find out on December 13.